By Julia Moravcsik

Credit: Pixabay

It’s only human to think that the world we live in now will continue forever. Even if we know logically it isn’t true, we imagine the future to be pretty much the same as it is now. We will be driving the same type of vehicles, living in the same type of homes, eating the same type of food, doing the same type of work. The idea that rapid change is right around the corner is ignored by our brains. Here are some funny quotes about this.

“We’ll have airplanes in 10 million years” – New York Times, 2 months before the Wright Brothers successful Kitty Hawk Flight

“There is no reason for any individual to have a computer in his home.” – Ken Olsen, Founder of Digital Equipment Corporation, 1977

“Everyone’s always asking me when Apple will come out with a cellphone. My answer is, ‘Probably never.’ It just ain’t gonna happen.” – David Pogue, Tech Columnist for the New York Times, 2006, 9 months before the first iPhone was released

Of course, it is often hard to predict new kinds of technologies that aren’t available yet. But it’s much easier to predict the adoption of technologies that are already here, but are still in the early stages.

New and different technology that displaces entrenched industries is called disruptive technology.

Like the people quoted above, most people disregard disruptive technologies. They either think that they will take much longer to spread than they actually do, or they think that they will be very similar to the technologies that they are displacing. When the iPhone first came out, many people thought it was a ridiculously expensive device for making phone calls. Nobody in the world could have predicted the many ways that smartphones have changed our lives and how fast they would spread.

DISRUPTIVE TECHNOLOGIES – HOW THEY WORK

Most of us have lived through disruptive technologies. The iPhone disrupted flip phones. Netflix disrupted Blockbuster. Uber disrupted taxis.

Disruptive technologies happen when the new technology becomes superior in cost and capability. If a new technology is cheaper and better than the old, people abandon the old technology and buy the new technology.

This rarely happens overnight. There is usually a long hidden period when the new technology is too expensive or it doesn’t provide enough value. Some people may hear about the technology on tech YouTube videos but nobody they know is buying one. Then maybe a few people they know have one, and then suddenly everyone seems to have one.

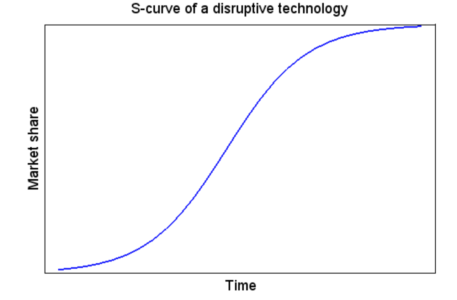

This adoption of new technology happens as an s-curve, as you can see in the graph below. It starts slow, and then increases exponentially, tapering off at the very end.

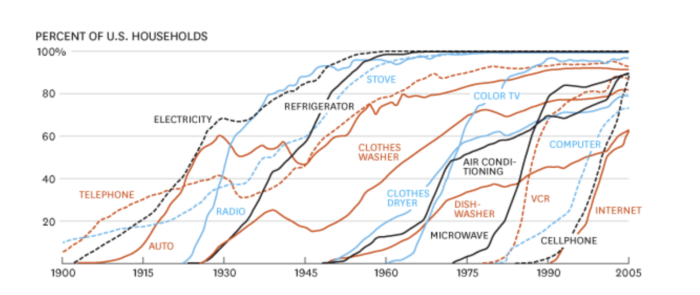

In the next graph, you can see the s-curve shapes in the adoption of actual technologies over the years. There are ups and downs but the s shape is visible in each one. One thing you can see is that the s-curves have become steeper with time. New technology gets adopted faster. ChatGPT, which came out only a few months ago, broke the record in this, with its s-curve almost being a straight vertical line. It went from 10 million users to 100 million in only a month or so.

Disruptive technologies have an s-curve shape, but the technologies they disrupt have an inverted s-curve shape. They start out by declining a little, then pick up speed, and slow down at the very end until they disappear altogether.

People are surprised by the suddenness of the increase in disruptive technologies and the decrease in the technologies that are disrupted. The reason for this is that people expect the adoption to be linear. They expect the slow adoption that they see in the very beginning to continue. Our brains tend to assume change to be linear, and disruptive technologies are no exception.

Credit: Pixabay

Disruptive technology is rarely created by incumbent big corporations. It is small startups that create the next generation of products. Incumbents might seem like they have the ability to create disruptive technologies. After all, they have lots of money for research and development and they have lots of talented employees in the field. They have two fatal flaws, however. First, they don’t have the culture for innovation. Large companies become complacent and stuck in their ways. Since what they have done in the past has created success, they continue on that path. Second, if they disrupt their own technologies, they could lose a lot of money. They have already invested in factories, employees, and systems for the old technology. They would have to discard all that if they innovated.

When an old technology gets disrupted, the company’s factories and other valuable assets lose their value. Nobody wants to buy factory machines that make flip phones. These assets are called “stranded assets”. Since a company’s value is calculated in part by the value of these assets, once they become stranded, the company is in dire financial shape, especially since they probably borrowed money to purchase them. They don’t know how to make the new product that the public wants, and their assets are worthless. These companies often go bankrupt or shrink rapidly. Giants that people thought would live forever are gone. The new giants are the once tiny startups that took the risks to create the disruptive technology.

CLEAN DISRUPTION: THE AUTOMOTIVE INDUSTRY

It’s a happy coincidence that just as we are on the verge of climate catastrophe, clean disruptive technologies are cheaper and better than the existing technologies. It would have been very sad if we had realized that the fossil fuel technologies, so essential for keeping 8 billion people alive, had no better alternatives waiting in the wings. Luckily, the alternatives to fossil fuel powered vehicles, energy, and homes are not only climate friendly, but cheaper and better for consumers.

Electric vehicles are an example of this. They are cheaper to fuel and maintain, and in a few years will be cheaper to buy. They are better in almost all ways. They are safer, more high tech, smoother, quieter, more responsive, accelerate and brake instantly, have fewer repairs, don’t stink, can be charged at home, and have very long lifespans.

Credit: Pixabay

People in the United States are complacent about EV adoption. Like everyone, they think EV adoption will happen linearly so they think they have plenty of time to buy a new gas car and fuel it at the many gas stations. Once they’ve had the car for five years or so, they figure they will sell it for a good sum and buy another one because there will be plenty of demand for used gas cars. Unlike you and I, they are unaware of the disruption s-curve.

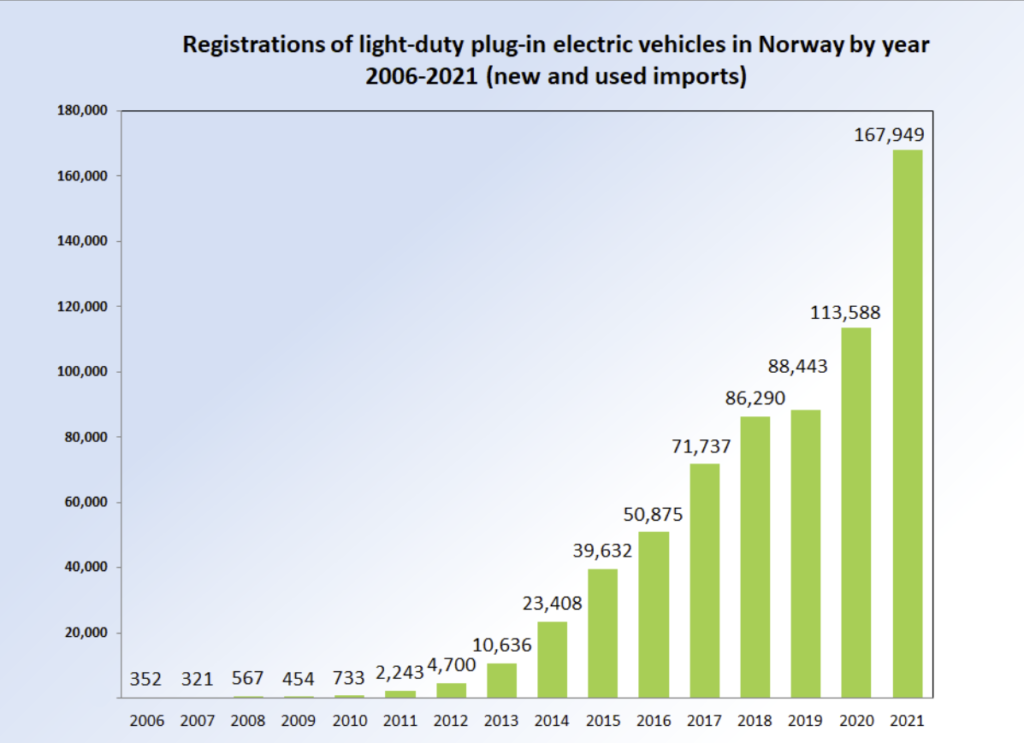

Norway is the leader in EV adoption. New cars in Norway are now about 90% electric. Here is the disruption s-curve of Norway’s EV adoption. This is what the future of the United States EV adoption looks like.

Who are the incumbent companies in the EV disruption? They are names we have known since childhood. Ford, GM, Toyota, Honda, VW, Kia and many others.

Who are the disrupters? Tesla was the original disrupter. Tesla innovated wildly, and produced the unique Model S, which was named car of the year when it first came out.

Right now, traditional automakers are also making EVs. However, they don’t make very many of them and their vehicles aren’t generally very innovative. If you look at new startup EV companies you can see much more innovation. Aptera, for example, is an aerodynamic dolphin-shaped solar vehicle that is 3 times as efficient as the average EV. Rivian has many unique and clever designs on its pickup truck. The Chinese EV companies, whose cars aren’t available here yet, have many interesting innovations like battery swapping and unique battery chemistries.

Will the incumbent companies like Ford, GM, and Toyota survive the EV transition? This is a matter of great speculation. However, there are reasons to think many of them won’t.

First, they currently lose money on their EVs. They subsidize their EVs with their gas cars. However, this can’t go on for very long. Many countries and states are phasing out gas cars in the upcoming years. Traditional automakers will have to take the plunge and stop making their profitable gas cars. Then all they will have are their money-losing EVs.

Credit: Pixabay

Second, traditional automakers don’t make much money selling cars. They make most of their money on financing and parts for repairs. But what will happen to their financing departments when used gas cars start to lose their value because people want EVs? Customers will default on their loans because the value of their gas car is less than what they owe. As a result, automakers will lose money on financing. As for parts for repair, EVs require much less repair and maintenance. So the two money making enterprises of the traditional automakers will be lost, just as they are spending billions ramping up their EV lines.

Right now, in the early stages of the EV disruption s-curve, the possible demise of traditional automakers seems laughable. After all, we watched the Superbowl and saw all the nice car commercials. We see dealerships all around our towns and cities. But you and I know about the disruption s-curve!

CLEAN DISRUPTION: THE ENERGY INDUSTRY

Solar today is the cheapest form of energy there is. Solar is cheaper than even the operating costs of natural gas and coal, not even taking into consideration the building of the plants. In some places, the cost of solar is cheaper than the cost of transmitting energy through the grid. In other words, in these places it is cheaper to create your own energy than buy it from the grid. The price of solar is still declining. Some experts think that it will decline another 70% in the next decade.

As I said before, disruptive technology happens when the new technology is cheaper and better than the disrupted technology.

Credit: Pixabay

Solar, like wind, is intermittent, so it needs to be stored when the sun isn’t shining. Batteries, another disruptive technology, are getting cheaper and better. Batteries may also be 70% cheaper in the next decade.

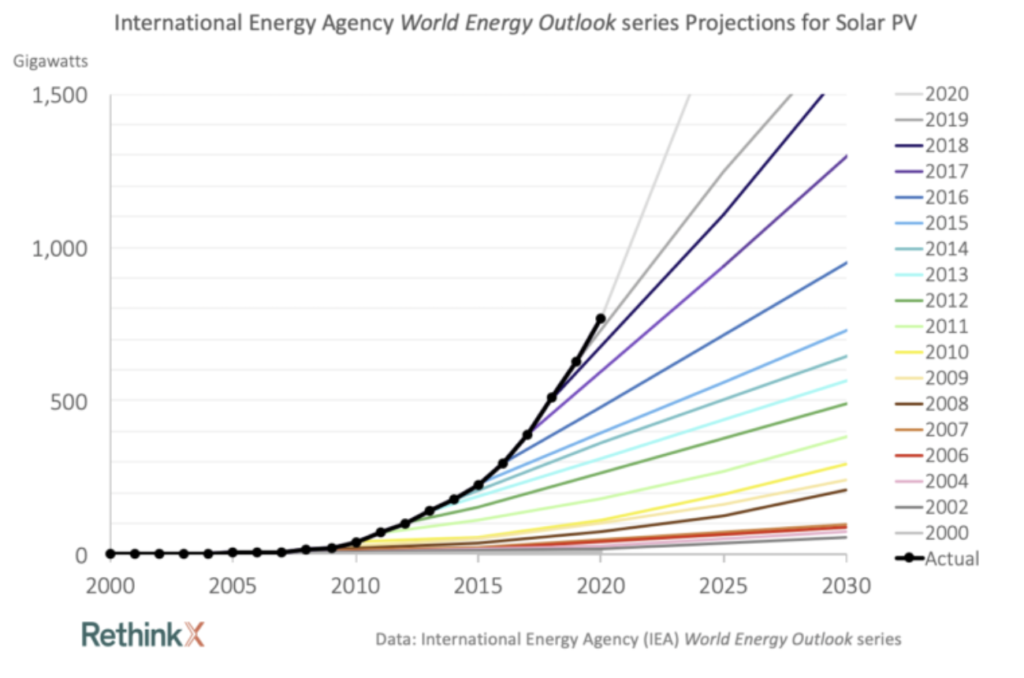

As solar gets cheaper, more and more solar is built. Like all disruptive technologies, the adoption of solar is an s-curve. As you know, most people think disruptive technologies, including solar, will increase linearly. However, the funny thing is that even some experts make this mistake.

In the graph below you can see the actual beginnings of the s-curve for solar, as shown with the black line. The colored lines were the predictions of the International Energy Agency for how solar adoption would proceed in the future. As you can see, at every point, they predicted that the curve would suddenly go linear. It makes you wonder why they didn’t look at their previous incorrect predictions and realize they were doing something wrong. It also makes you wonder why the head of the International Energy Agency didn’t fire the committee that made these predictions!

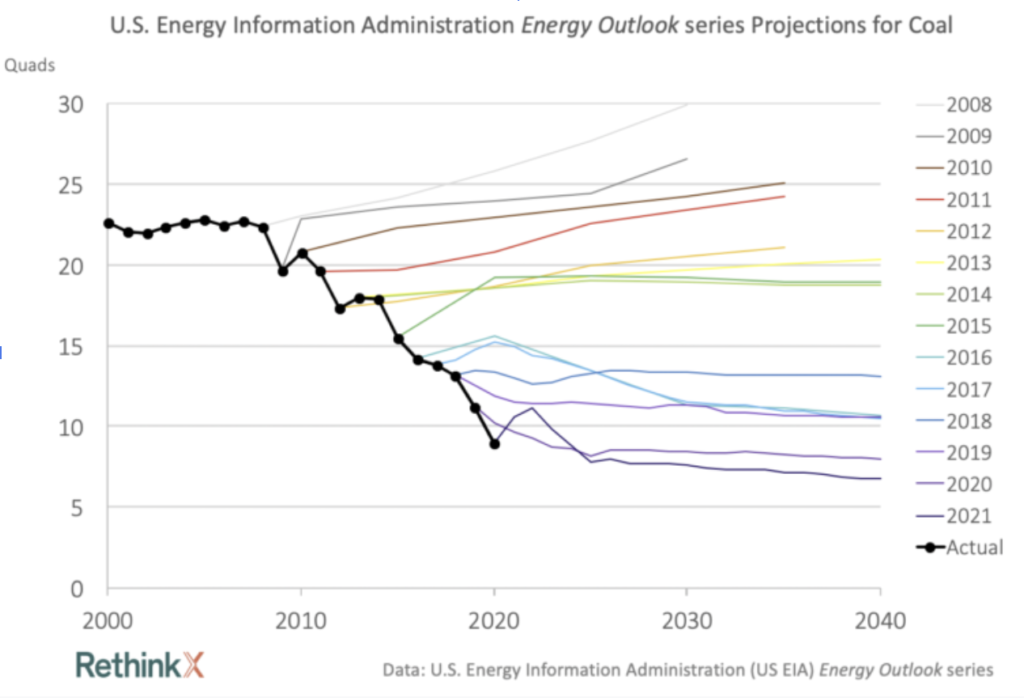

As I said before, technologies that are disrupted have an inverse s-curve shape. The next graph shows the U. S. Energy Information Administration’s predictions for the future use of coal. Just as with the solar example, these people thought that the curve would suddenly become linear. If these experts make this same mistake over and over, imagine how the public thinks about it. There are very few people who predict these disruptions by using an s-curve, despite the fact that there are countless examples of it and it is accepted as fact by people who study disruptions.

INVESTING IN OIL AND GAS

The stock market can turn on a dime. Companies can suddenly become adored by investors, and their stock price can skyrocket. Just as quickly, companies can be abandoned by investors and the stock is practically worthless. The stock market is controlled by human psychology, and its tendency to follow the crowd.

As we saw, people, even experts, are usually oblivious to the speed and extent of a disruption. They think it’s a slow, linear process. But at some point – we don’t know when – there will be a crowd shift where people suddenly realize that oil and gas is declining faster than expected. Even if it’s early in the decline, if many investors realize this, or follow other investors who realize it, then the value of oil and gas investments could suddenly plunge, never to rise again.

350 Colorado is working on several projects to remove money from the oil and gas industry. This is not only good for climate, it’s good investing.

The Fossil Free PERA Colorado campaign works to remove oil and gas investments from pensions. Pension plans should be investing in safe areas, not industries that are on the verge of exponential collapse.

The Colorado Public Banking Coalition campaign is working to create local public banks that are socially and environmentally responsible, which includes not investing in the risky fossil fuel industries.

Join these projects to spread the word about the financial dangers of investing in disrupted technologies and to help defund climate destroying industries.

LEARN MORE ABOUT DISRUPTIVE TECHNOLOGIES

For more on disruptive technologies, watch Tony Seba’s YouTube channel or read “The Innovator’s Dilemma” or read this blog post on The Incumbent Mirage.

In addition to being a 350 Colorado volunteer, Julia Moravcsik is a co-founder of Go Electric Colorado (a home electrification organization), the president of the Denver Electric Vehicle Council, a co-leader for Citizens Climate Lobby’s Electrification Action Committee and the events coordinator for the Denver Tesla Club. She is working with Coltura to spearhead legislation to phase out gas cars and incentivize high mileage drivers to get EVs in Colorado and other states. She participates in many EV shows and manages a monthly EV show at Lafayette Cars and Coffee. She is an Aptera Brand Ambassador.