Save the Date and Join Us! August 25th – 28th you are invited to join us for a group trip to the beautiful Grand Tetons National Park in Wyoming, where the Federal Reserve is having its national annual meeting, to participate in an in-person action to demand a Fossil-Free Federal Reserve! It’s time for the Federal Reserve, the US central bank, to set policies to dissuade the big banks from investing in fossil fuel companies and projects!

We will have a peaceful demonstration outside the event and create a presence that can’t be ignored. We will have A LOT OF FUN! We’ve rented a group camping site at Colter Bay Village on beautiful Jackson Lake, located in the national park. The campgrounds are top-notch, with several restaurants, a general store, gift shop, wifi, etc., and there are ranger walks, horseback riding, canoes and kayaks to be enjoyed if you wish! 350.org will cover transportation costs, food costs (up to $15/meal), and the group camping site costs. All you need to do is bring your personal items, a tent and bedding for camping (or let us know if you would prefer to stay in shared RVs we’re renting).

We will have carpools leaving for Wyoming on Wednesday, August 24th, and Thursday, August 25, and you are welcome to join us at the campsite on whichever day you prefer! Please indicate in the RSVP form which dates you will plan to leave and return to Colorado. Learn more & share the Facebook event here.

Questions? Don’t hesitate to reach out to giselle(at)350colorado.org

Background: Why the Economic Policy Symposium is Key to Raising Awareness & Spotlighting Our Demands

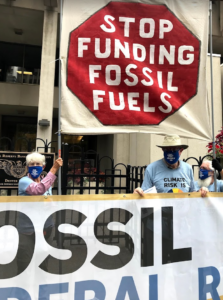

In front of the Denver Federal Reserve Building last year.

In August 2022, the annual Jackson Hole Economic Policy Symposium is a critical gathering of economists, federal bank CEOs, chairmen, and board members, who are making decisions about U.S. financial flows. However, by failing to account for the role of the climate crisis, and propping up fossil fuel investments, they are putting our economy & climate at risk.

The top economists of the United States and the world must recognize the critical risk fossil fuel investments pose to our economy and get on board with the imperative to keep warming under 1.5 degrees.

Since the Paris Agreement, the world’s 60 biggest banks have financed fossil fuels to the tune of $4.6 trillion. Runaway funding for fossil fuel extraction and infrastructure fuels climate chaos and threatens the lives and livelihoods of millions. US banks are the top fossil fuel funders. (https://www.ran.org/wp-content/uploads/2022/03/BOCC_2022_vSPREAD-1.pdf)

Last year, an IEA report defined “no investment in new fossil fuel supply projects, starting today” as critical for net-zero emissions by 2050. The UN Secretary-General has echoed this by saying, “We can no longer afford big fossil fuel infrastructure anywhere. Such investments simply deepen our predicament.” Yet banks have made clear they will not stop financing fossil fuels.

The International Energy Agency and the IPCC have been crystal clear: we cannot finance any new fossil fuels — full stop. And we need to quickly wind down existing fossil fuel projects. The Federal Reserve must set portfolio limits and penalties on fossil fuel finance for financial institutions, like Chase bank.

Central banks (including the Federal Reserve, which is the USA’s Central Bank) are the referees of the financial system, holding power to enforce new rules and cut the flow of money to fossil fuels. The Federal Reserve has the power to set rules for how banks behave, and as such should direct banks to make decisions in line with Paris Agreement targets.

What We Want The Fed to Do (Our Demands):

-

350CO protests in front of the Denver Federal Reserve Building, Earth Day 2022

As climate impacts devastate our communities and planet, the Federal Reserve must make it clear that they are no longer investing in the culprits of climate chaos.

- A key mandate of the Federal Reserve is to assess and account for risks to the U.S. economy. We are calling on them to fulfill their mandate. It’s time to push the Federal Reserve to do what they said they would do: account for climate risk.

- We Need a Climate Leader for Our Economy: The Federal Reserve is the referee of the economy. When banks do bad, the ref is supposed to blow the whistle. US banks are driving the planet, and the economy, off a climate cliff.

- We need The Fed to step in and steer us off fossil fuels fast. Can they do that? Yes, it’s their job to manage risk and they have the legal authority to manage climate risk out of the banks.

- We are calling on the Federal Reserve to:

- End fossil fuel finance through the banks & phase out all fossil fuel financing by 2030. The Fed should use existing regulatory and supervisory tools to begin limiting and phasing down the financing of emissions through curbing bank lending to fossil fuel infrastructure and projects.

- Align Fed spending and asset purchases with the Paris Climate Agreement’s goal of limiting temperature rise to 1.5°C; The Fed should encourage and support bank investment aimed at limiting global temperature rise to 1.5°C, with an emphasis on lending to low-income communities and communities of color.